Home Mortgage

Save money on your home purchase with our competitive mortgage rates.

- Choose a team, identify the perfect neighborhood, and make the correct offer when buying a property.

Affordability calculator for Home loan

There are numerous factors that influence how much property you can comfortably purchase, including your salary, debt, and preferred down payment. Our affordability calculator can do some of the work for you.

- Credit score

- Down payment

- Media Connection

- Loan term

- Interest rate

- Closing costs

Apply Now

Get your dream home

The perfect home begins with the proper mortgage

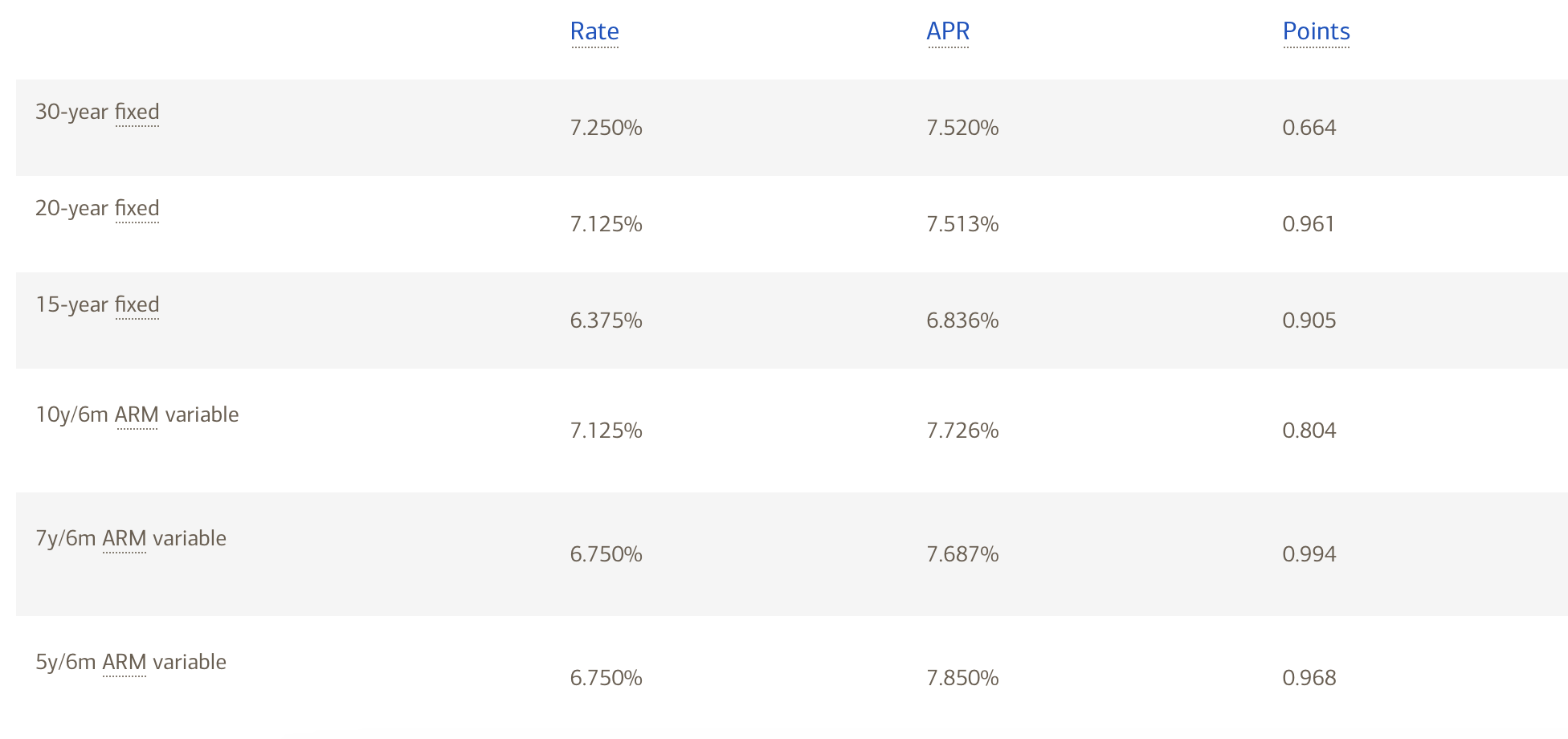

Fixed-rate mortgages

Your interest rate remains the same for the entire loan term

Your monthly payment of principal and interest does not change during the loan term

Adjustable-rate mortgages (ARMs)

Interest rate may change periodically during the loan term

Your monthly payment may increase or decrease based on interest rate changes

- A no-cost, no-obligation prequalification request that takes about 5 minutes

- Experienced lending specialists to help you every step of the way

- Easily manage the entire process online through Home Loan Navigator™

PREQUALIFICATION VS. PRE-APPROVAL COMPARISON

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

- Constant Improvement

- Commitment to Customers

- Best Quality You Can Get

Many home Approvals

By understanding the home loan application process and being prepared with the necessary documentation and information, you can increase your chances of a smooth and successful loan process.

Monthly Country wide Approval

© Copyright. Investors Credit Union, Registration number 1998/0830939/02. All rights reserved | Authorised Financial Services Provider and a registered credit provider.